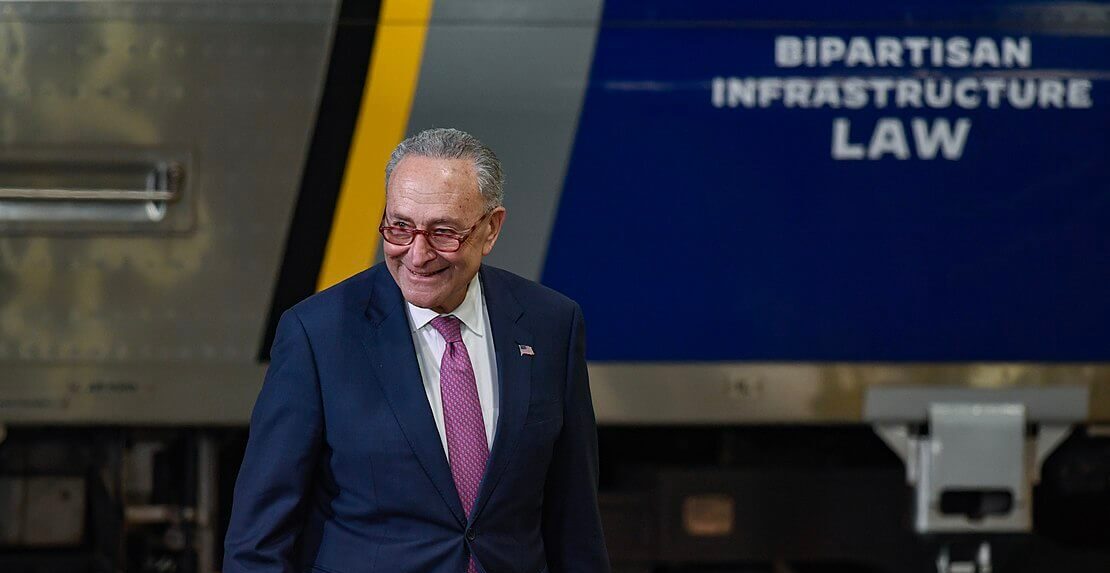

US Senate Majority Leader Chuck Schumer recently announced that the bipartisan marijuana banking bill, known as the Secure and Fair Enforcement Regulation (SAFER) Banking Act, will be among the top policy priorities for Senate consideration this year. The announcement came during a leadership press briefing when Schumer was asked about the legislative agenda ahead of the November elections.

Emphasizing the importance of bipartisan support for the numerous bills passed by the Senate, Schumer expressed his commitment to working diligently on these issues.

The Focus Areas for the Senate

Alongside the SAFER Act, other policy focal points include rail safety legislation, insulin affordability, and several auxiliary concerns. Schumer clarified, “after that, you will see us turn to many of the bills that we passed: the SAFER Act, safety on the rails, [the RECOUP Act], so many other things.” The process, however, could be challenging due to varying opinions from different political segments.

House of Representatives Makes Progress

In the meantime, the House of Representatives has already made headway toward comprehensive cannabis reform, passing an appropriations package exempting state-legal marijuana operations from federal intervention. Schumer had previously mentioned how lawmakers aim to “hit the ground running” in 2024 by addressing key legislative areas, although he admits accomplishing these goals “won’t be easy.”

Senators Support Cannabis Reform

Senator Maria Cantwell and several other senators have joined the ranks of lawmakers pushing for progressive cannabis regulation reform. As the continued growth of legal marijuana businesses necessitates better access to crucial financial services, the passage of the SAFER Act could prove to be a significant step forward for the industry. In addition, the bill would provide increased security for state-legal businesses and pave the way for further development in the sector.

Implications of the SAFER Act

If enacted, the SAFER Act will offer numerous benefits for marijuana businesses and financial institutions. It is designed to facilitate better access to banking services for cannabis companies operating within states where marijuana has been legalized for medical or recreational purposes. Such protections would ensure that legal cannabis enterprises have the resources necessary to grow and develop.

The SAFER Act and Financial Institutions

As for the financial institutions involved, the passage of the SAFER Act would help provide much-needed clarity on their role in serving this budding market. Currently, many banks and other financial service providers are hesitant to work with cannabis businesses due to concerns surrounding federal laws and potential repercussions. By enacting the SAFER Act, this hesitation can be mitigated, contributing to the growth of the legal marijuana industry while ensuring its compliance with existing regulations.

Public Opinion on Cannabis Reform

With an increasing number of Americans now in favor of legalizing marijuana at the federal level, the subject of comprehensive cannabis reform remains a highly debated topic among lawmakers and the public alike. A recent poll revealed that nearly two-thirds of US voters support nationwide legalization, indicating a gradual shift towards a more accepting attitude.

Economic Impact of Cannabis Legalization

Besides public opinion, economic factors also play a critical role in driving the need for updated cannabis laws. Tax revenues generated by legal marijuana sales continue to rise steadily, benefiting local governments and funding various social programs. In addition to creating new job opportunities, cannabis legalization could lead to considerable economic growth, particularly in small businesses.

A Milestone for Marijuana Advocates and Businesses

US Senate Majority Leader Chuck Schumer’s prioritization of the bipartisan marijuana banking bill is undoubtedly a significant step towards comprehensive cannabis reform in the country. The SAFER Act’s enactment would not only afford legal marijuana enterprises better access to essential banking services but also fuel further growth within this promising industry.