The United States has filed a notice announcing the auctioning off of more than 2,900 bitcoins, valued at over $130 million. These digital tokens are connected with the famous Silk Road forfeitures and the result of the shady dealings on darknet marketplaces.

The Background of the Confiscated Bitcoin

The forfeiture of these bitcoins can be traced back to a former Secret Service agent and his father, who were both involved in a conspiracy to transfer funds. The pair attempted to transfer the confiscated bitcoin into a foreign bank account for their own personal gain. As a result of their convictions, both individuals were ordered to return their ill-gotten gains to the US government.

The Secret Service agent had previously been convicted for manufacturing and distributing drugs in exchange for bitcoin on darknet marketplaces. He eventually admitted to accessing a digital wallet belonging to the US government, transferring the confiscated bitcoin into other wallets he had access to for personal benefit. Apart from the agent and his father, another individual was also involved in the scheme and has agreed to return stolen bitcoin to the US authorities.

The Legal Proceedings

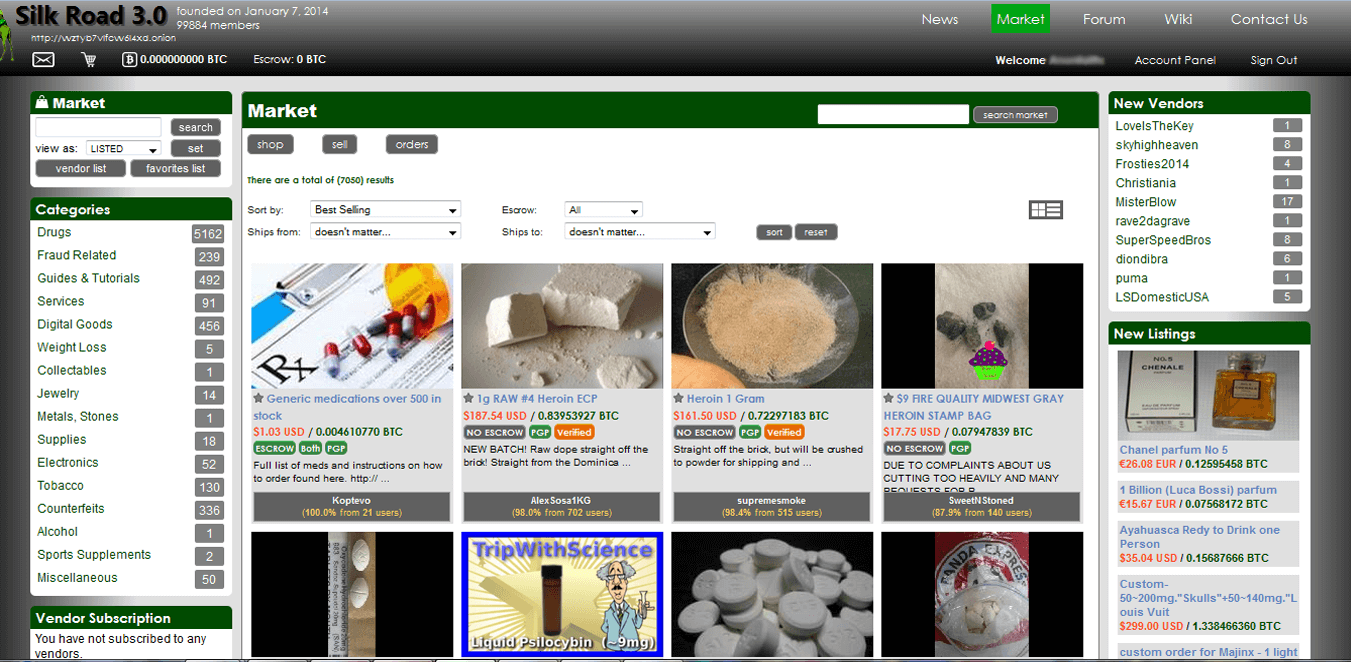

The legal proceedings against these individuals go back years, stemming from dismantling the infamous Silk Road marketplace. Operated by Ross Ulbricht under the pseudonym “Dread Pirate Roberts,” the Silk Road was an online black market responsible for countless illegal transactions involving drugs, weapons, and various other illicit activities.

Upon its closure, US authorities confiscated thousands of bitcoins used in these transactions, intending to convert them back into legitimate funds. Some government officials saw the potential for personal gain and tried to manipulate the situation in their favor, leading to additional legal issues surrounding this nefarious currency.

Previous Bitcoin Auctions by the US Government

The US government has taken similar measures in the past, selling off seized bitcoins to convert them back into fiat currency. In 2014, more than 144,000 bitcoins confiscated from Silk Road were auctioned off in sales worth approximately $100 million. Since then, the value of Bitcoin has risen significantly, reaching an all-time high of over $64,000 in April 2021 before experiencing a market correction.

These auctions elicit significant interest from investors, with previous iterations attracting participation from major players such as Tim Draper and Barry Silbert. The sale of these forfeited tokens allows such parties to acquire large sums of bitcoin at potentially favorable prices while contributing to government revenue through the proceeds generated from these sales.

The Impact on the Cryptocurrency Market

Auctions involving substantial amounts of bitcoin often prompt intense speculation within the cryptocurrency community about the potential near-term effects on the digital token’s valuation. Despite some concerns, history has shown that the direct impact of large-scale auctions in the broader Bitcoin market tends to be relatively limited.

This can partly be attributed to the fact that many large-scale buyers involved in these proceedings, including reputable names like Draper, have long-term investment horizons in mind when acquiring such digital assets. As a result, immediate floods of newly-acquired bitcoin into the open marketplace are highly unlikely, mitigating any potential destabilizing effects on overall valuations.

Conclusion: Moving Towards Legitimization

With the upcoming auction of more than $130 million in forfeited bitcoin linked to the Silk Road case, the US government aims to take another step towards establishing an increasingly regulated and transparent cryptocurrency industry. Actions like these demonstrate that criminal elements seeking to abuse digital currencies for nefarious purposes will continue to face legal consequences, contributing to the overall legitimacy of the rapidly evolving crypto landscape, especially now that there is a cryptocurrency cannabis market.

While these auctions may not thoroughly cleanse Bitcoin’s image as a currency of choice for criminals, they help to reduce its prevalence in illegal online transactions. This shift aligns with the ongoing efforts of various regulatory bodies and governments across the globe, working together to strike a delicate balance between fostering innovation and maintaining robust financial safeguards in the evolving world of digital finance.